17+ dti for mortgage

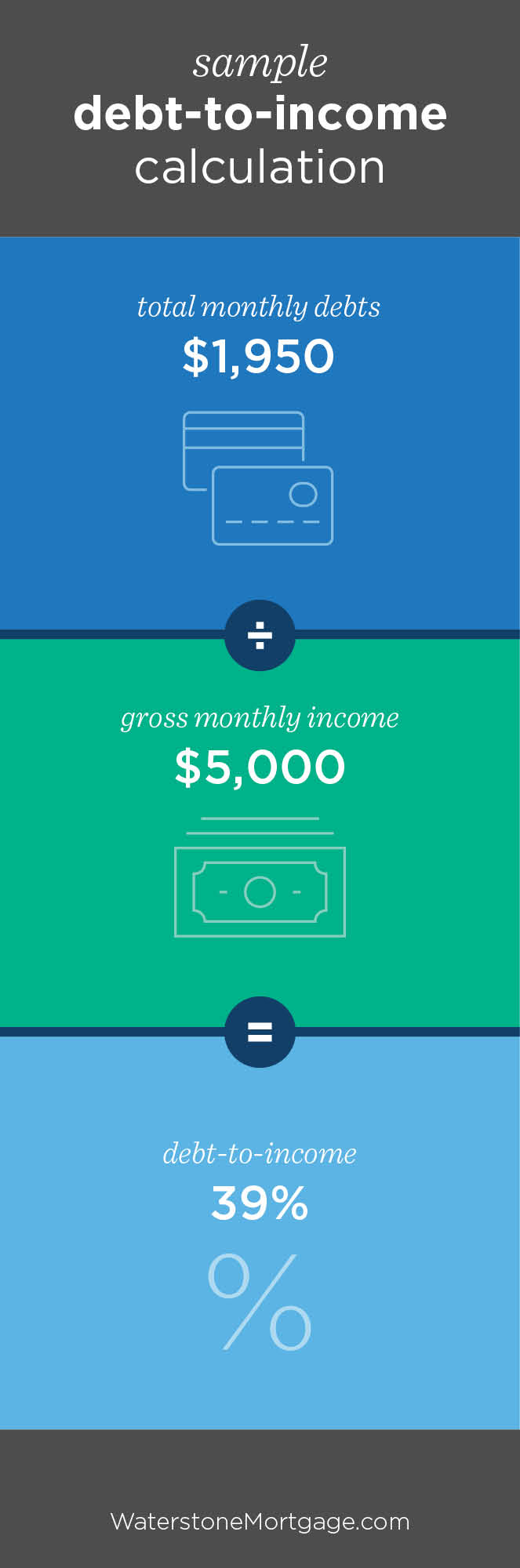

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. To get the back-end ratio add up your other debts along with your housing expenses.

Fannie Mae Will Ease Financial Standards For Mortgage Applicants Next Month The Washington Post

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

. Up to 43 typically allowed. Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. Web Maximum Debt-to-Income Ratio for Mortgages.

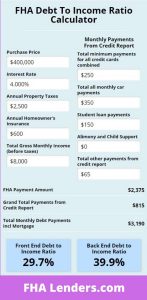

Your lenders maximum DTI limit will depend partly on the type of loan you choose. You have a pretax income of 4500 per month. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments.

Multi-sectoral micro-enterprises in business for at least 1 year. Multiply that by 100 to get a. Heres how lenders typically view DTI.

Web 15-year fixed-rate mortgages. Your monthly expenses include 1200. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Standard FHA guidelines in 2022 allow homebuyers to have a maximum debt-to-income ratio of 43 in order to. Web However the precise amount depends on factors like mortgage amount household size and your ZIP code. Web How to calculate your debt-to-income ratio.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web Regular salary of 45000 pa converts to 3750. Also called a PITI ratio principal taxes interest and insurance this number reflects your total housing debt in relation to your monthly.

Child benefit for one child. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web Debt-to-income ratio total monthly debt paymentsgross monthly income.

The average rate for a 15-year fixed mortgage is 622 which is a decrease of 11 basis points compared to a week ago. Web Maximum DTI by type of loan. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

RISE UP Micro Multi-Purpose Loan. Web Front-end DTI. This includes cumulative debt payments so think credit card.

If your DTI exceeds 41 however you will need at.

Debt To Income Dti Ratio What S Good And How To Calculate It

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Regulator Ends Debt Ratio Standard For Mortgage Approvals Orange County Register

2023 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

How To Calculate A Debt To Income Ratio For A Mortgage Guild Mortgage

How To Calculate Your Debt To Income Ratio Rocket Money

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

:max_bytes(150000):strip_icc()/MortgageRates_whyframestudio-6aa583d504f34e758a2b63f052308838.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

Ad Mortgage Loans A D Mortgage Llc

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx

What S An Ideal Debt To Income Ratio For A Mortgage Nesto Ca

How To Lower Your Dti Ratio

Immc Swd 282020 29502 20final Eng Xhtml 5 En Autre Document Travail Service Part1 V6 Docx